|

Unfortunately,

all too often the link between supply and demand is broken or is

not too precise. Many retailers receive shipments of merchandise

from their suppliers in “prepacks” and then send these

along straight to their stores, believing incorrectly that a) the

relevant unit of analysis is the style and not the item and/or b)

that it is not worth the time and effort to place orders, and sort

them in their warehouses, at the item level (size & color).

This is a serious mistake, since prepacks by definition follow a

standard distribution of sizes, usually some variation of a bell

curve. However, human beings do not fit neat statistical patterns

and every time we have run Size Distribution of Sales reports for

our customers, we have been surprised by how much variation we see:

a particular woman’s black boot may sell a lot of sizes 8s

and 5s and the same boot in a different color may sell a lot of

6s and 5s while a similar boot with a higher heel may sell predominately

sizes 9 and 10. Customers are a wonderfully varied lot and making

it impossible to predict the distribution of your sales with any

great accuracy.

Retailers

whose distribution system relies on prepacks are without a doubt

carrying substantially sub-optimal inventory. Usually, items in

the middle of the size run sell out first, at which point the retailer

then orders another prepack to restock that item as quickly as possible,

but the other sizes, particular those on the end of the size run,

have not sold out, so excess inventory begins to accumulate. In

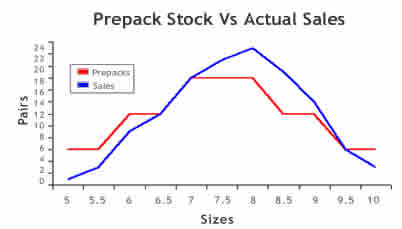

the graph below, we have shown a hypothetical example where the

prepack follows an even distribution in increments of 6, 12 and

18 pairs while the actual sales follow a more random distribution,

in this case, showing that larger sizes are more popular for this

style. For those sizes where sales are below the prepack level (sizes

5 – 6.5 & 10) the retailer is overstocked; for those sizes

where sales are above the prepack (sizes 7.5 – 9) the retailer

is understocked. This leaves the retailer with two unpleasant options:

order another prepack, in which case he will accumulate even more

unnecessary stock (in sizes 5 – 6.5 & 10) or wait till

he sells the remaining inventory in these sizes in which case he

is losing sales in the sizes that are out of stock (sizes 7.5 –

9). The problem is multiplied every time the retailer reorders a

prepack or waits to sell-down inventory. We had one customer whom

we discovered had 24 pairs in inventory of the smallest size of

a particular style. Why 24? He had ordered 24 prepacks in the last

year every time the best-selling size sold out and not once had

he sold a shoe in the smallest size. Every time he ordered a prepack

he was accumulating a souvenir--and a very expensive one at that!

Some

retailers know prepacks are inaccurate but argue that it is not

worth the extra expense to implement an item-based inventory control

system that gives them greater accuracy. These retailers’ main

concern is speed: they like to order the prepacks from their vendors

and deliver them as is to their stores, the quicker the better,

to make room for the next shipment. Our experience has shown that

typically a quarter of a retailer’s inventory is stagnant,

i.e. stock levels are much higher than sales while sales could be

20% higher if they made sure to never be sold out of items that

customers are looking for. These are huge numbers that translate

into substantial profits and far outweigh the additional costs that

controlling inventory at the item level entail. Information is a

lot cheaper than shoes or transportation costs. Regarding the argument

that item-based inventory control slows down the distribution system,

remember our friend the Chicago retailer whose sales kept growing

but profits were disappearing¾a clear case of over-supply

ruining GMROI (Gross Margin Return on Investment). Speed is not

an inherently good thing to have; it is a catalyst and will accelerate

the consequences of your decisions, good or bad. If excess inventory

is eating away at your profits, then selling and ordering even more

prepacks will not help. The goal of any retail operation, after

all, is higher profits, not necessarily more sales that drag down

the bottom line.

Now

prepacks are not a uniformly bad idea. If a given stores has a certain

sales volume then maybe it wouldn’t hurt to send them one prepack

to start off with, but then they need to fill in per size color

as the initial shipment sells to improve accuracy. Often vendors

allow you to order “pre-packs” and one-size packs (for

example 12 pairs of size 9). So based on past experience you could

track that you need one prepack per store plus a certain amount

of one size packs per certain sizes. Our point here is that you

need an automated system to be able to fill in the holes where these

extra shoes are needed. It will not always be the same size at the

same store.

The

strength of a big chain of stores versus a single store should be

their ability to statistically “even out” their sales.

In any given sales period, a certain store can sell an unusual amount

of size nines while another can sell a weird amount of size 6. However,

when you take the sales of the full 40 stores it will be unusual

for there to be extreme variations in sizes versus the past history

for that type or department of shoe. However, when variations do

appear, the retailer needs to adjust inventory levels. Even small

variations can have a large impact over time. The way to cover these

variations is through an item-based automatic resupply system, and

for that you need to use Minimums & Maximums.

|

|