Chapter Topics

Overview

Order Cost

Inventory Cost

Modifying the Cost of an Item

Cost Audit Log

Overview

This chapter discusses the different costs that XpertMart™ uses, the Order Cost and the

Inventory Cost, and the Cost

Audit Log where all cost information for an item is stored. Subsequent

chapters discuss how to change the cost of an item using a Cost Adjustment or how to make massive changes to the costs of multiple

items. There are also special considerations to keep mind when you are

setting up your inventory for

the first time to keep your accounting of costs straight..

Order Cost

The Order Cost of an Item is the cost at which you expect to

receive that Item from your Vendor. The Order Cost functions as a reference

as it is the cost that XpertMart™ automatically

enters into any Purchase Order or Receipt. You are free to change this price at the

moment you are making the Purchase Order or Receipt, but if you choose

not to then your Order Cost will, in fact, be the Inventory Cost used.

The Order Cost appears in the Items Catalog

and can either be entered directly into the Order Cost field of the Items Catalog or

is automatically filled in from the Styles Catalog

when you check the "Price/Cost

from Style" checkbox. Unlike prices where there can be multiple price lists, the Order

Cost is the same for all stores throughout the company.

Inventory Cost

Every time you receive merchandise XpertMart™

automatically records the cost that was used in the Receipt into the Cost Audit Log. For every Item, XpertMart™ keeps a running average of the costs from every Receipt.

This average is the Invenventory Cost. When you are using XpertMart™ correctly, the Inventory Cost is the most realistic indicator

of what your merchandise is costing you. You can always see how XpertMart™ is calculating the Inventory Cost by opening the Cost Audit Log.

The Inventory Cost appears in the Inventory

Cost field of the Items Catalog just below

the Order Cost. The value in this field cannot

be edited as it is written-in automatically and the average is updated every

time you make a new Receipt for that item.

The Inventory Cost is the same for all stores in the chain.

Whenever you make an Invoice, XpertMart™ takes

the prevailing Inventory Cost at that moment for every Item and records it

(though you cannot see this on screen). This is the cost used to calculate

your margin.

Modifying the Cost of an Item

You cannot directly edit the Inventory

Cost of an Item. Keeping with our Philosophy of Control, any change to

the cost of an item must be done through a document that creates an audit

trail. There are only two documents that can change the Inventory Cost of

an Item: a Receipt or a Cost Adjustment.

When you employ the Mass Changes to Prices

and Costs tool what you are in fact doing is creating a batch of Cost Adjustments.

Cost Audit Log

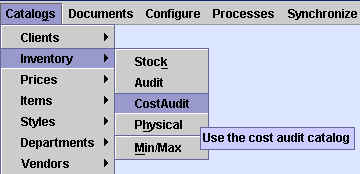

XpertMart™ stores every instance of

an item being received, and the cost it was received at, in the Cost Audit

Catalog, also called the Cost Audit Log. You can view the contents of this

catalog by going to the Catalogs>Inventory menu and selecting Cost Audit,

as shown below.

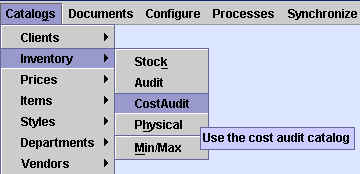

Every record in the Cost Audit Catalog displays, for a particular Item,

the following information:

Cost Audit Date: the date the transaction took place;

Initial Quantity: the quantity in stock before the transaction

took place;

Original Cost: the average Inventory Cost

prior to the transaction;

Quantity Received: quantity of items received, if any;

Document Type: the type of transaction (either a Receipt or Cost

Adjustment);

Received Cost: this is the Net Cost of the Item on the Receipt;

New Cost: the new average once the Received Cost has been factored

in. This is the prevailing Inventory Cost

until a new Receipt or Cost Adjustment is made for this Item.

The entries in the Cost Audit Catalog appear in chronological order and

as such are of limited use in understanding your costs. To get a clearer

picture, run the Cost Audit Log report by clicking on the Reports button ![]() in the toolbar at the top of the catalog:

in the toolbar at the top of the catalog:

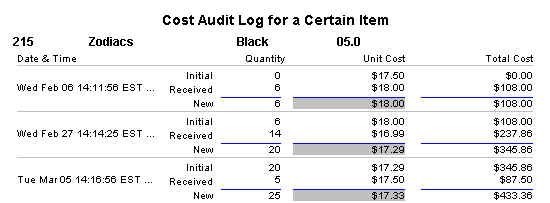

The Cost Audit Log for a Certain Item Report looks like this:

The report displays the same information that the Cost Audit Catalog does but allows you to see multiple entries at once and therefore see how the average changes with every transaction. In the example above, the Order Cost for the Black Size 5.0 Zodiacs platform mule is $17.50. However, the first time a Receipt was made, on February 6th, the Net Cost on the Receipt was $18.00. Therefore, the new Inventory Cost was $18.00.

The second time this item was received the Net Cost on the Receipt was

$16.99. When you average 14 pairs at $16.99 with the 6 pairs at $18.00,

you get a new Inventory Cost of $17.29.

The third time the item was received the Net Cost on the Receipt was $17.50,

yielding a new Inventory Cost of $17.33. This

means that each one of the 25 pairs of Black Size 5.0 Zodiacs you have

received so far is costing you $17.33 on average.

NOTE: The "Initial" quantity of an entry in the log does not necessarily

need to be equal to the "New" quantity of the prior entry. If in the intervening

time pieces of merchandise were sold, the "Initial" quantity of the new

entry will of course be lower than the "New" quantity of the prior entry.

Copyright © 2002 XpertMart