The AR module uses the same Client Catalog to store all of the data of credit account customers. There are a few fields and one toolbar button used especially for AR:

Accounts Receivable

Chapter Topics

Introduction

Clients

Catalog

AR

Catalogs

AR

Transactions

AR

Documents

AR

Processes

AR

at the Point of Sale

Receiving

AR Payments at the POS

AR

Reports

Introduction

XpertMart™’s

Accounts Receivable (AR) module gives you all of the tools you need

to manage your sales on credit with your customers. To begin with,

the module can be used as a stand-alone program to manage credit

accounts without ever interacting with the Point

of Sale. In addition, the AR module can also be used as a fully

integrated part of XpertMart’s Point of Sale.

XpertMart™’s AR module resides on the Main in the Multi-Store Edition and can be included in the Single-Store Edition. In a multi-store setup the Remote Stations only interact with the AR module through the Point of Sale.

Clients Catalog

The

AR module uses the same Client

Catalog to store all of the data of credit account customers.

There are a few fields and one toolbar button used especially for

AR:![]()

The first field is Credit Limit. At the Main Station this field is editable and used to put the customer’s maximum credit limit. The second field is Balance, which is not an editable field. The AR Module will automatically update this field with the amount owed by the client. The third filed is Days Credit. This field can be edited at the Main station and is used to enter the maximum number of days the customer has to pay for the purchases bought on credit. In transactions made at the Point of Sale the Due Date will automatically appear as the Days Credit added to the current date of the transaction. The Days Behind field displays the days that have passed since the balance was due.

The Client

Catalog also includes a special button to open the AR Audit Log. The

button looks like the yellow Kardex

button with a green dollar sign on it as shown below:![]()

When

you click on this button a new window will open with the AR Audit Log

for the custome you are looking at, as shown here:

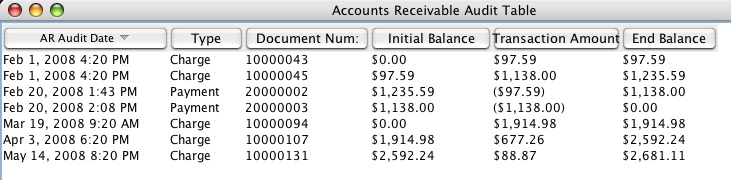

The AR Audit Log gives a complete transaction history for a

customer's credit account. It includes the date and time in which a

transactions was made, the type of transaction which was made, the

unique document number for the transaction followed by the starting

balance prior to the transaction, the amount of the transaction and

finally the ending balance after the transaction is accounted.

AR

Catalogs

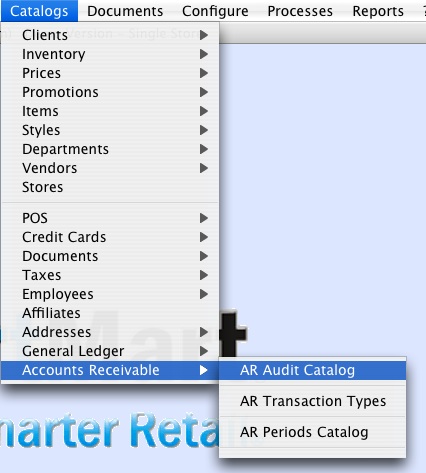

The

data which appears in the AR Audit Log is stored in the AR Audit

Catalog. This catalog

can be oepend by going to Catalogs>Accounts Receivable>AR Audit

Catalog as shown below:

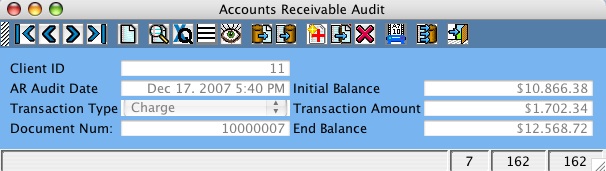

When

you select this option, the AR Audit Catalog will open up, as shown

below:

As

can be seen in this image, this catalog has the same data found in AR

Audit Log. Perhaps the main reason for using the AR Audit Catalog is

to run the reports

associated with this catalog.

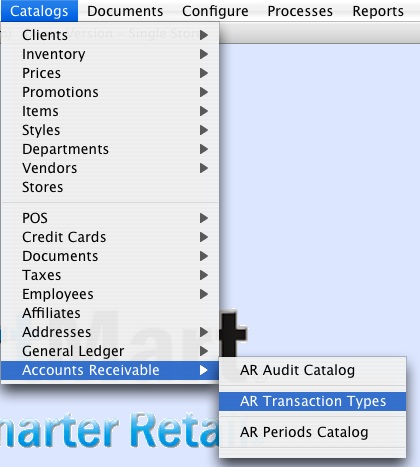

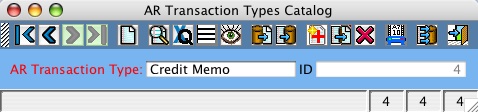

The names given to the different

Accounts Receivable transactions may vary from company to company.

Therefore, the user can name these transactions as desired in the AR

Transaction Types Catalog. This catalog can be opened by going to

Catalogs>Accounts Receivable>AR Transaction Types, as shown

below:

Once

you select this option the AR Transaction Types Catalog will open.

The catalog includes a field where you can assign a name as well as

an internal ID number that is not editable.

XpertMart™

uses

Transaction Type ID = 1 as a charge or something that was sold on

credit and for which payment is still due. You can give this

Transaction Type whatever name you wish but XpertMart™

will assume it is a charge. Transaction Type ID = 2 is used as a

payment against a balance that is due. Transaction Type ID =3 is used

a debit memo. These are used for charges that do not arise from

normal sales. For example, debit memos can be used for surcharges if

a check is returned, for a late fee or special interest charge. The

last Transaction Type is ID = 4 and is

used for credit memos which are used to credit an account and reduce

the amount owed outside of taking in a payment. For example, if you

offer a discount for quick payment, you would want to use Transaction

Type ID = 4. As mentioned before, you can use whichever names you'd

like for these transaction typeswithout affecting the underlying

functionality just described. At present, only four transaction types

are used.

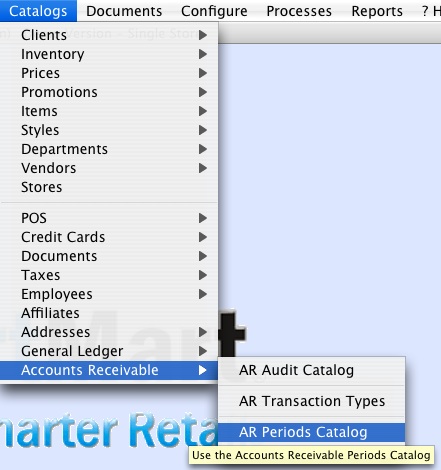

A central feature of the Accounts Receivable module

is clasifying debts by due date and the time that has lapsed since

then. XpertMart™ allows you to define the

lenght of time periods you wish to use to track overdue payments.

Normally the periods used are: 0 - 30 days, 30 - 59 DAYS, 60 - 89

dayns and over 90 days. To define these periods, use the AR Periods

Catalog. To open this catalog, go to Catalogs>Accounts

Receivable>AR Periods, as shown below:

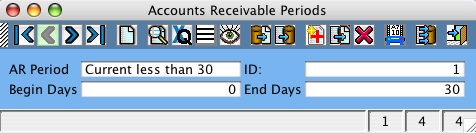

Once

you select this option, the AR Periods Catalog will open, as shown

below:

Use

the first field for the name you want to use for the period. You can

use whichever name you like. Then select how many days past due mark

the beginning of hte period and how many days past due mark the end

of the period. As can be seen in the image above, you must have an

initial period that starts with zero days past due. This initial

period is for accounts that ar considered current. You can use the

number of days you'd like, but the important thing is not to skip any

days. For example, if one period ends with 30 days then the next

period must begin with 31 days. Also, you must enter the periods you

want to use in order such that Period ID = 1 is used for current

accounts, Period ID = 2 is used for accounts that are more than one

day past due, and so on. The AR

Aging Report will used these periods to display overdue

accounts.

The last entry in the AR Periods Catalog is for all

delincuent accounts over "x" days past due. For example, if

the final period runs to 120 days, then you must add another entry in

the catalog which begins with 121 days past due and runs to 9,999

days past due. This period could be called "More than 120 Days"

for example.

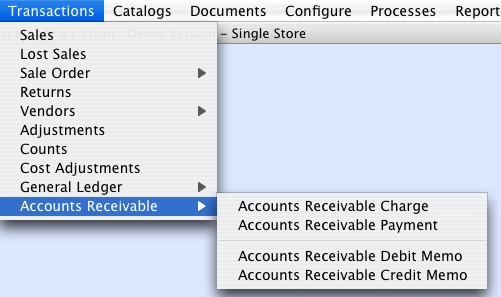

AR

Transactions

All

four

transaction types in the AR module can be processed manually. To

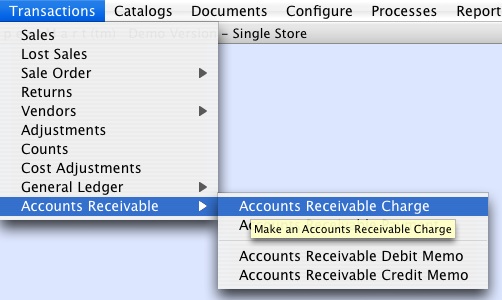

make any one of these transaction types, go to Transactions>Accounts

Receivable, as shown below:

The

first type of AR Transaction is a Charge which gets recorded as a

balance that needs to be paid at a future date. To make a Charge

transaction, go to Transactions>Accounts Receivable>Accounts

Receivable Charge, as shown below:

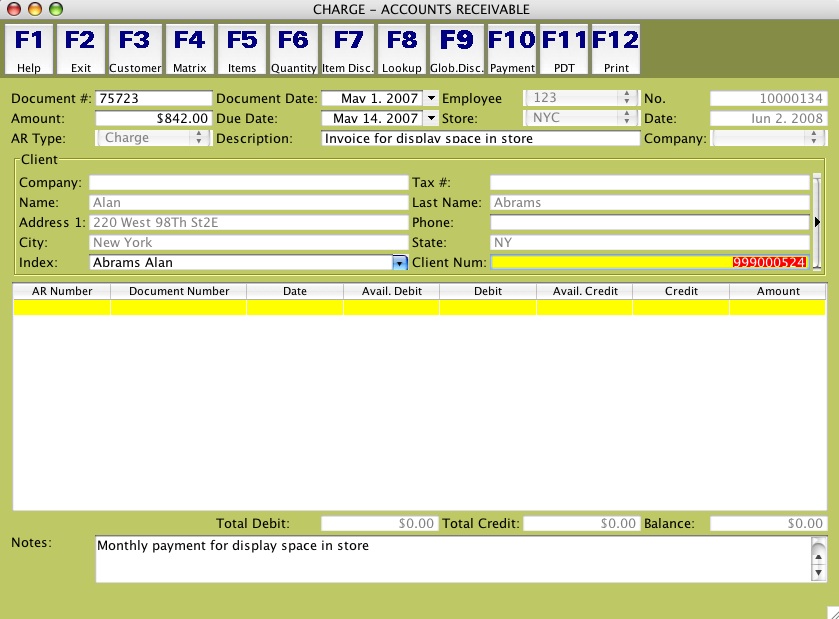

Once

you select this option, a new transaction

screen will open up, as shown below:

There

are a number of fields in which to enter data. The Document

# field refers to the number of the document which generated the

Charge such as the number of the invoice which was sold on credit.

The Document Date refers to the date of the document which generated

the charge. This date may be different than the date of the Charge

itself. The Employee field is non-editable and is filled in

automatically with the Employee

Number of whoever is logged in at the time. The No. field is the

unique document number for this charge transaction. This number is

generated automatically by the system and runs sequentially starting

with 10,000,000.

On the second line of the transaction screen

is the Amount field which is where you enter the amount that is being

charged. The Due Date field is where you enter the date on which the

amount being charged is due for payment. The Store

field displays the store number where the charge is being made and is

filled-in automatically by the system and is not editable. If you are

making the charge at the Main

then this field is left blank. The Date field displays the date of

when the charge is being made (today's date) and is not editable.

On

the third line, the AR Type field displays the name for the

transaction type you entered into the AR

Transaction Types Catalog with an ID = 1. This field is not

editable. The Description field is an open field where you can enter

a description for the charge being processed.

The Client

field works the same way it does in an Invoicing

screen. You can do a Lookup

by Example by Last Name to enter the client for which the Charge

is being processed.

The next section details the AR

transactions and documents which are used to pay this charge. The

Total Debit, Total Credit and Balance fields reflect the totals of

all transactions listed in this section. The Balance field displays

the total amount of the charge minus any credits and debits which

have been applied. This transaction details section is explained

below.

Lastly, the Notes field allows you to enter an

explanation for the charge being process or include special

instructions.

If after entering all of the relevent

information pertaining to a charge in the fields described above you

wish to appy any open credits or positive balances, you can do so

simply by pressing the Payment <F10>

button.

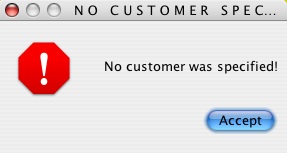

When you press <F10>

the system will first check to see if the charge transaction has all

the required information. The system will first check to see that

you've entered a Client. If you have not specified a client you will

see this error message:

If

the client has not been specified you need to do so before

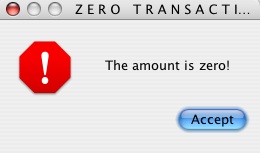

proceeding. Next, the system will check to make sure the amount

entered is greater than zero. If no amount has been entered in the

Amount field, you will see this error message:

If

you have not entered an amount fo the Charge you will need to do so

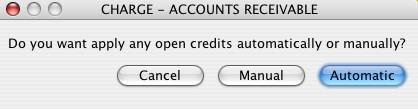

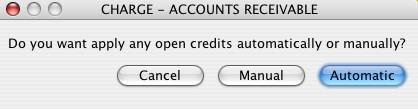

before proceeding. Next, the system will prompt you with this window

asking if you 'd like to apply any open credits automatically or

manually:

At

this point you need to decide if you'd like to apply any open credits

yourself of let the system do it. If you are not ready to decide,

press <Cancel>.

Whenever

XpertMart™ automatically

applies open credits it will always apply these to the oldest

document first and, if there's still a positive balance left, will

then apply it to the second oldest document and so on in order. If

the balance of the open credit is less than the total amount due on a

document then XpertMart™ will

apply the full credit and leave the remaining balance as pending to

be paid.

If

on the other hand you elect to apply open credits manually then you

can decide the amounts you wish to apply to the documents of your

choosing.

Below is a sample of how XpertMart™

applied an

open credit automatically:![]()

The first thing to notice ist aht XpertMart™

will add a

line which registers the current transaction being processed. In the

image above, the first line refers to AR Transaction number 10000014

and the amount being charged is $300.

The second line shows

that XpertMart™ found

document number 20000001 which has an open credit of $17.50 which has

not yet been applied to any prior document so XpertMart™

is applying

it now. That's why it shows up under the Credit column.

The

image below, on the other hand, shows what happens if you tell

XpertMart™ you

want to apply the credits manually:![]()

In

this case XpertMart™ also

finds the open credit of $17.50 from document 200000001 which this

client has in their favor. Since this credit has not been used

before, XpertMart™ places

it in the Available Credit column so that the user knows it's

available. If you wish to use this credit then you have to manually

enter the amount ($17.50) in the Credit column. Or you can choose to

only use a portion of this credit and enter it in the Credit

column.

To save and print these changes you need to click

<F12>.

Note that if before you press <F12>

you change the amounts or enter a different client then XpertMart™

will not save any of the transaction

detail. You must press <F12>

for your transaction detail to be saved.

Just

as when you press <F10>

to commit a Charge, XpertMart™ will

check to see that you've specified a client and have entered an aount

before printing. XpertMart™ will

also check to see that you've specified a Document Number and will

display an error notice if you have not.

If all of the

infromation is complete (client, amount and document number) then

XpertMart™ proceeds

with the transaction. If after applying open credits the Charge still

has an active balance then XpertMart™ will

ask you if you'd like it to apply any open credits to the document.

These would be any open credits you had

previously not applied. If you'd like XpertMart™ to

apply these automatically, then click <Apply>.

If you'd like to leave the balance as pending to be paid, then click

<Don't

Apply>.

If you decide you don't wish to save and print the transaction then

you can click <Cancel> and the transaction screen will

clear out.

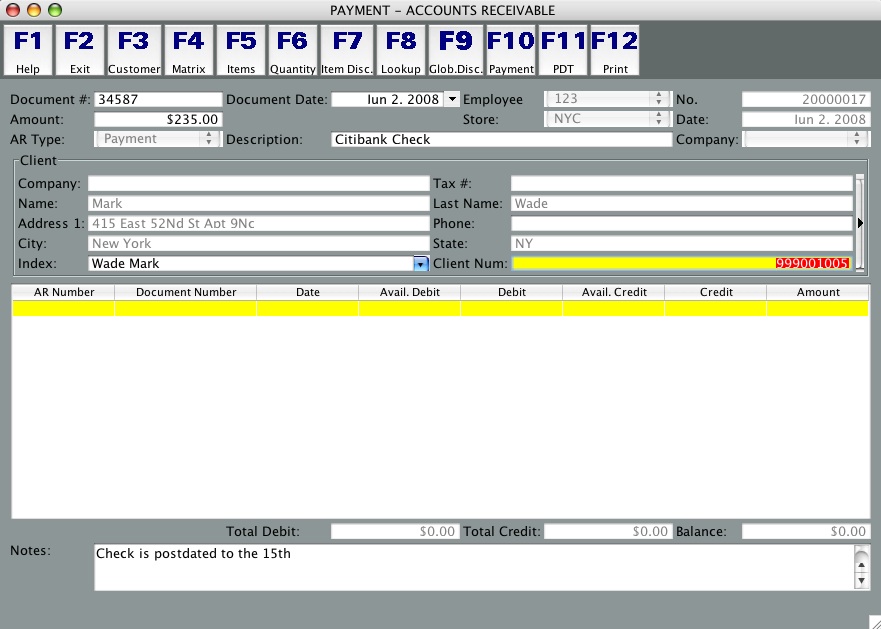

The

second type of AR transaction you can make is a Payment. To do this,

go to Transactions>Accounts Receivable>Accounts Receivable

Payment. This will open a new transaction window, as shown

below:

As

can be seen above, the fields that need to be filled out are the same

as when making a Charge

transaction. The only difference is that the amount will be credited

to the customer's balance instead of debited. All AR Payment

documents begin with document number 20,000,000. When looking at the

AR Audit Log you can tell just by looking at the document number

which transactions are Payments (start with 2) and which are Charges

(start with 1).

The <F10>

Payment button works the same way only instead of applying credits

you will be applying debits. This is because you will be choosing

which open balances to apply this payment against.

The <F12>

button works the same as before and is used to save and print the

transaction. None of the payments are applied until you actually

press <F12>.

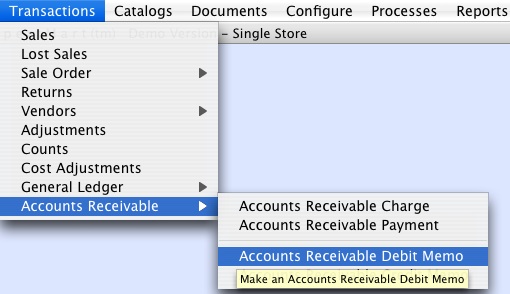

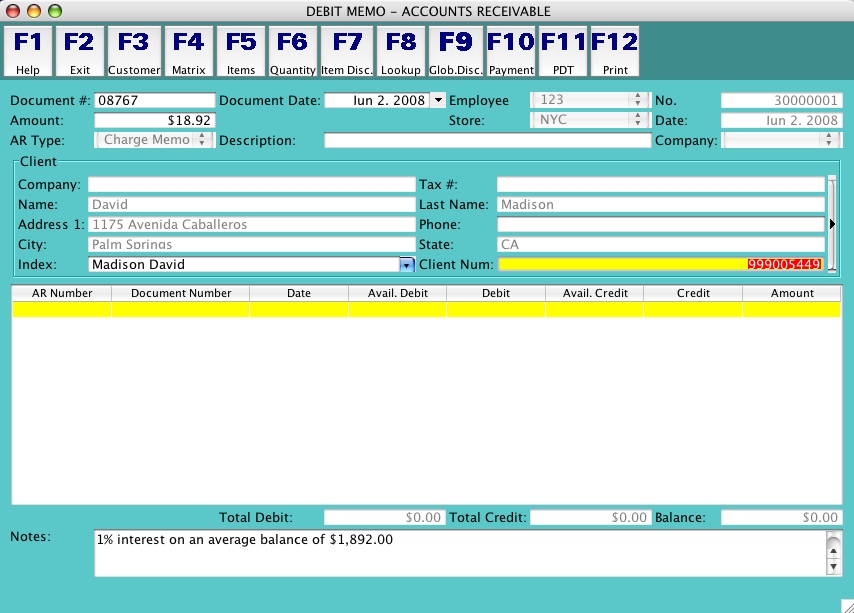

The

third AR transaction type you can make are Debit Memos. These are

used to register a charge to a client's account for something that is

not a merchandise sale. To make one, go to Transactions>Accounts

Receivable>Accounts Receivable Debit Memo, as shown

below:

Once

you select this option, a new transaction window will open, as shown

below:

As

seen with Charges

and Payments,

the fields to fill out are the same and the <F12> and <F12>

keys work the same way. In fact, a Debit Memo works exactly like a

Charge does, the only difference being the document number which

starts with 30,000,000.

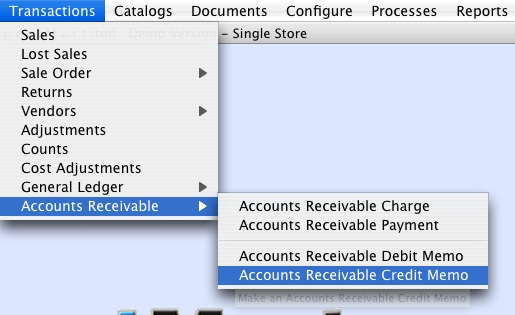

The final AR transaction type are

Credit Memos. These are used to reduce the total balance due for any

reason other than a payment. To make one, go to Transactions>Accounts

Receivable>Accounts Receivable Credit Memo, as shown

below:

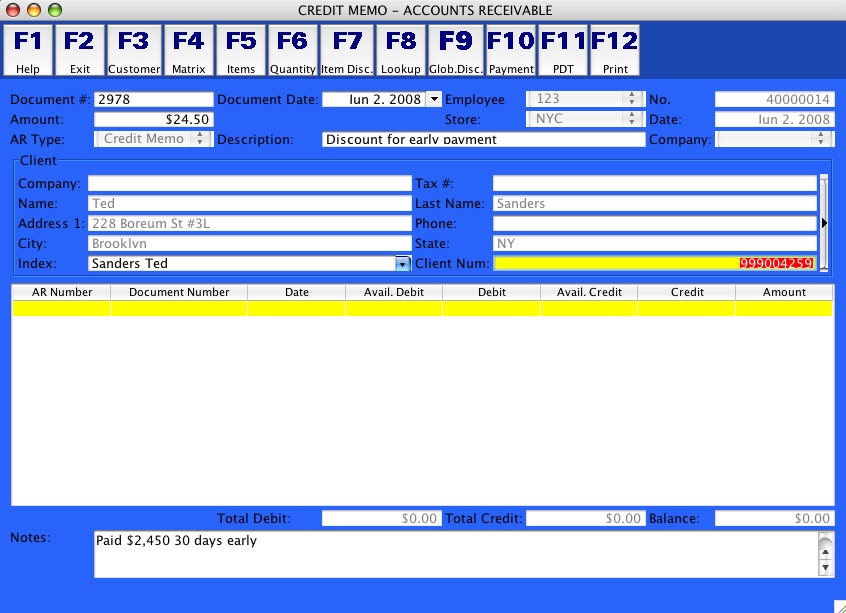

Once

you select this option, a new transaction window will open, as shown

below:

As

seen with Charges and Payments, the fields to fill out are the same

and the <F12> and <F12> keys work the same way. In fact,

a Crebit Memo works exactly like a Payment does, the only difference

being the document number which starts with 40,000,000.

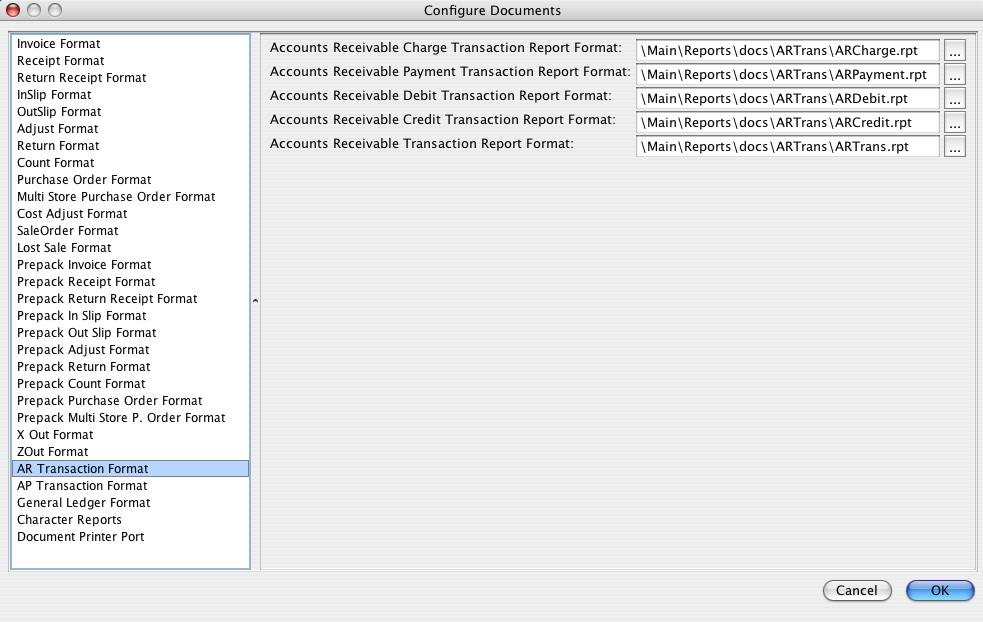

The

printing

format for each of the four AR transaction

types can be set by going to Configure>Configure Documents>AR

Transaction Format.

Select

the report format you want to use for each transaction type. The

default formats are shown above.

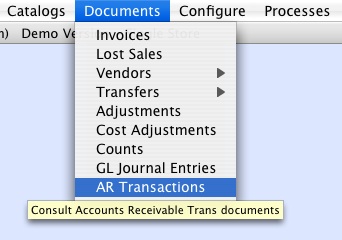

AR

Documents

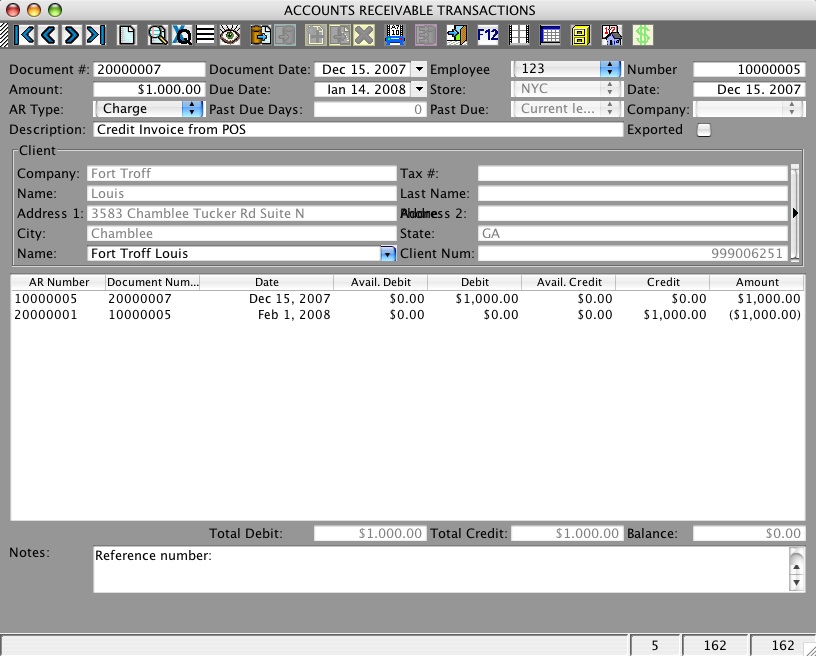

All

AR

Transactions get stored as Documents.

These documents can be found under Documents>AR Transactions, as

shown below:

Once

you select this option, a Catalog of previous AR Transactions opens

up, as shown below:

All

four AR Transaction

Types are found here. You can use all of XpertMart™'s

usual

Catalog

and Search

functions to find the data you're looking for.

The AR

Documents screen has two addiitional fileds that the AR

Transaction screen does not have. The Past Due Days field

displays how many days past due is the balance. The number of days

past due is based on the last time you ran the process to calculate

days past due. The Past Due field displays the AR

Period the balance falls under.

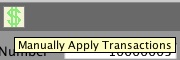

The AR Transactions

catalog also includes a Payment

button you can use to apply payments to open charges (or

vice-versa). The Payment button has a dollar sign on it and looks

like this:

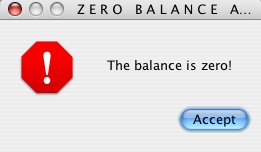

When

you press the button, XpertMart™ will

check to see if the balance on the transaction you are looking at is

zero. If the balance is zero then it is no longer necessary to apply

any payments, in which case you'll see this notice:

After

displaying this message XpertMart™ will

not do anything further since the transaction does not have any open

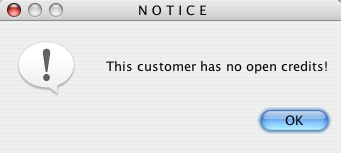

balances. If on the other hand there is an open balance then

XpertMart™ will check to see if the client in question has any

open credits or any payments that have not yet been applied. If the

client does not have any open credits or payments waiting to be

applied, you will see this notice:

After

displaying this message XpertMart™ will

not do anything further since the transaction does not have any open

balances.

If

the balance is greater than zero and the client does in fact have

open credits then XpertMart™ will proceed

to ask you if you'd like the open credits applied automatically or

manually, the same way it does in an AR Transaction screen when you

press <F10>.

You will

see this dialogue window:

The

functionality here is the same as described earlier when using the

<F10>

Payment button in a Transaction screen. The only difference is

that instead of pressing <F12> to save the changes and print,

in the Documents screen you will press the Payment button on the

toolbar a second time to commit the changes.

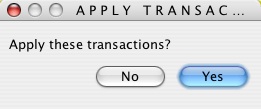

When

you press the Payment button a second time the system will ask you to

confirm that you want to commit these changes to the Document you are

looking at.

Press

<Yes>

to commit these changes to the Document. If you press <No> the

credits will not be applied.

Note that the example above

dealt with applying open credits to Charges

and Debit Memos but the procedure is exactly the same for apply open

debits to Payments

and Credit Memos.

AR

Processes

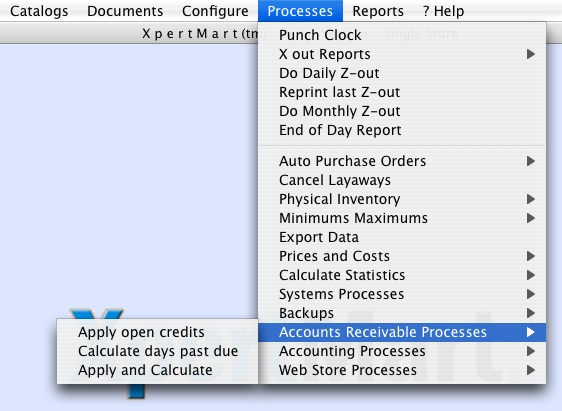

There are two processes you

should run regularly to keep your Accounts Receivable up to date.

These two processes are found under Processes>Accounts Recevable

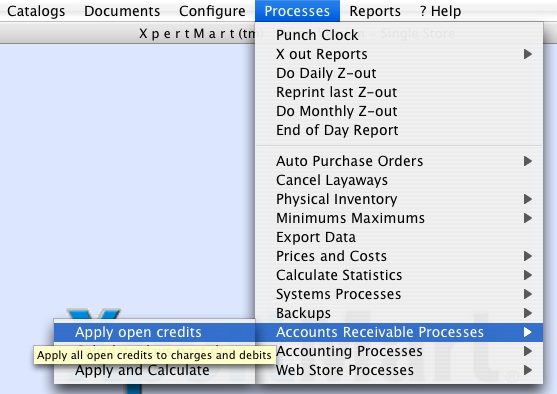

Processes, as shown below:

As

previously mentioned, XpertMart™ can

automatically apply

open credits by taking any open credit and applying it to the

oldest open debit or charge document and working its way formard. If

you'd like XpertMart™ to do this for every single client where

there is an open credit then you can select Processes>Accounts

Receivable Processes>Apply open credits, as shown below:

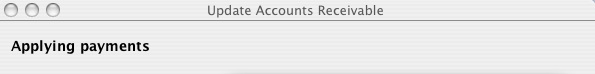

Once

you select this option, a dialogue window will appear notifying you

that XpertMart™ is applying the open

credits.

When

the dialogue window closes it means the system is done applying open

credits.

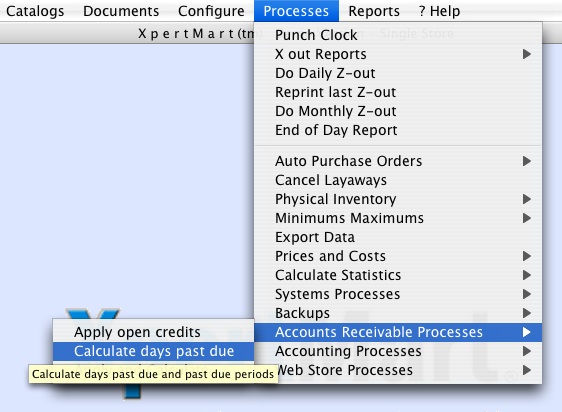

The second process consists of calculating how many

days past due every balance is and under which AR

Period the charge falls under. To do this, go to

Proceses>Accounts Receivable Processes>Calculate days past due,

as shown below:

When

you select this option a dialogue window will appear notifying you

that the system is calculating the days past due. When the dialogue

window closes it means the system is done calculating days past due.

Note that the number of days past due is based on the last date you

ran the Calculate days past due process so it is important to run

this processes before running any AR

Reports.

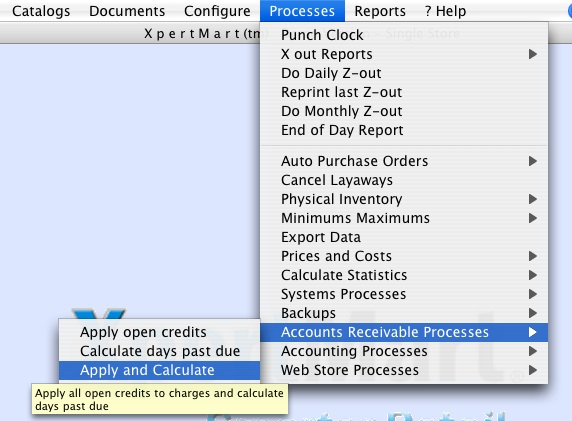

The last option in the Accounts Receivable

Processes menu is to run both processes at the same time.

When

you select this option XpertMart™

will first apply all open credits and will then calculate days past

due. This way if after applying an open credit a charge now has a

balance of zero it will show zero days past due and the account will

be considered current.

This

concludes the overview of Accounts Receivable as a stand-alone module

in XpertMart™. We will now see how AR

integrates into the Point of Sale.

AR

at the Point of Sale

Once

you've setup the three AR

Catalogs then you are ready to begin selling on credit at the

point of

sale. You need to setup one configuration setting at the Main

in order for credit sales at the POS to be automatically

applied to a client's account through the AR module. To set this

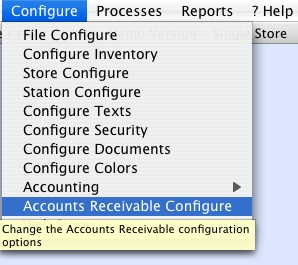

up, go to Configure>Accounts Receivable Configure, as shown

below:

When

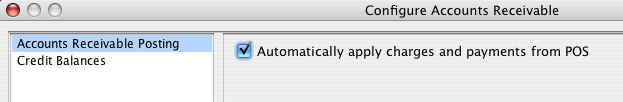

you select this option the Configure Accounts Receivable window opens

up, as seen below:

The

first configuration option on the left-side menu is Accounts

Receivable Posting. If you check the box that says "Automatically

apply charges and payments from POS" then the system will

automatically update each client's records in the AR Module. If you

don't check this option then all charges and payments made at the POS

are left open for you to apply later at the Main using the AR Module.

If you're going to be applying charges and payments automatically at

the Main anyway, you might as well go ahead and select this

configuration option now.

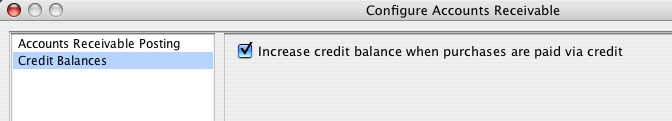

The second configuration option is

called Credit Balances.

If

you select the "Increase credit balance when purchases are paid

via credit" box then each client's available credit will adjust

dynamically as payments are made and open credits are applied.

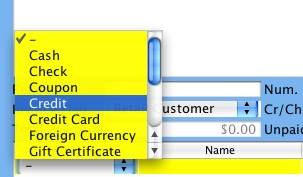

To

sell on credit at the point

of sale all you need to do is select "Credit" as the

Tender

Type, as shown below:

Note

that Credit must be Payment Type ID = 7 when you setup the Payment

Types Catalog. Refer to the Required

Entries topic for further informaiton.

When you select

Credit as the tender type XpertMart™ will

first check to see if you've entered a Client

in the Invoice. If you have left the Client field blank, XpertMart™

will not

let you use Credit as a tender type.

Next, XpertMart™

will check

that the Client you've selected has available credit greater than the

amount being charged in the Invoice. Available credit is calculated

as the Credit

Limit you entered in the Client Catalog minus any open charges

and debits that have not yet been paid.

If you are using

XpertMart™'s

Single Store Edition then any sale made on credit will automatically

be applied at that moment to the AR Modlule. If you are using the

Multi-Store Edition then all sales made using the Credit tender type

will be applied to the AR Module after a synchronization

cycle.

XpertMart™ will

record the Invoice number as the Document number in the AR

Transaction. In the Notes field of the AR Transaction, XpertMart™

will insert

the Invoice's reference field. The AR Module

will record a Due Date equal to the date of the Invoice

plus the Days Credit you've previously assigned in the Client

Catalog.

Receiving

AR Payments at the POS

You can also receive payments towards a clients AR balance at the

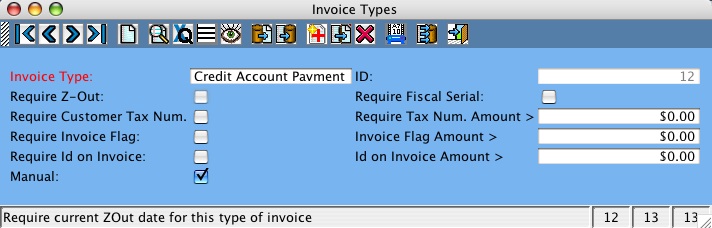

point of

sale. To be able to do this you first have to create new entries

in two catalogs. First, create an Invoice Type with ID = 12 called

"Credit Account Payment" in the Invoice Types Catalog which

is found under Catalogs>Document Types>Invoice Types.

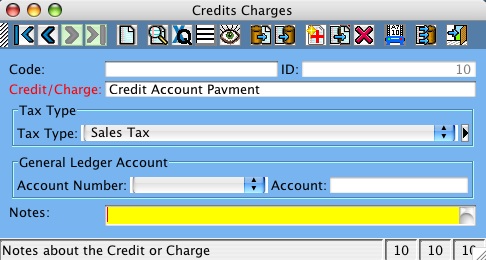

Next,

create a Credit/Charge type with ID = 10 called "Credit Account

Payment" in the Credits Charges Catalog which is found under

Catalogs>POS>Credits/Charges.

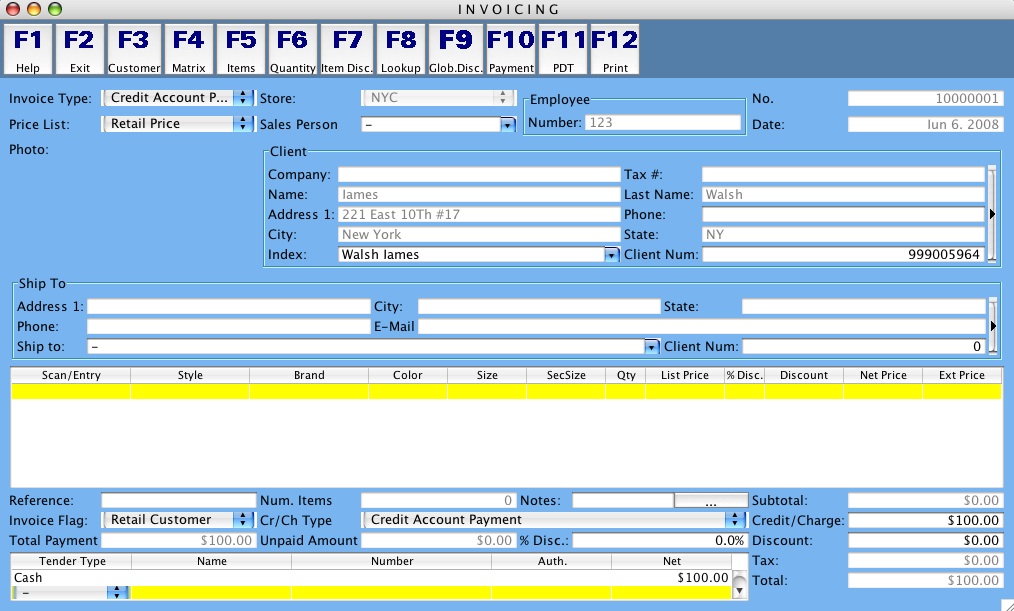

When

you're in an Invoicing

screen if you pick Invoice Type ID=12 (Credit Account Payment) then

XpertMart™ will

automatically fill in Credit/Charge Type ID = 10 int he Cr/Ch Type

drop-down menu. In the Creidt/Charge field, enter the amount the

client is paying. Obviously you also need to enter a ame in the

Client field and you must specify the Tender Type being used to make

the payment. In the example below, the Client is making a $100

payment towards his AR balance and is paying cash.

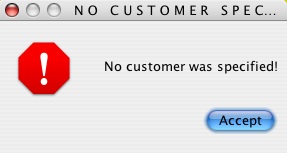

XpertMart™

will check

to see that all required data has been entered. If you have not

specified a Client, you will see this error notice:

You

must specify a Client in order to continue. Likewise, XpertMart™

will check

to see that you are using Credit/Charge Type ID = 10. If you are not,

you will also see an error notice and you will have to change the

entry in the Cr/Ch Type drop-down

menu to Credit Account Payment.

As with selling on credit at

te point of sale, if you are using XpertMart™'s

Single Store Edition then any payments made at the point of sale will

instantly be applied to the AR Module. If you are using XpertMart™'s

Multi Store Edition then they will be applied after a full

synchornization

cycle.

XpertMart™

will record

the Invoice number as the Document number in the AR

Transaction. In the Notes field of the AR Transaction, XpertMart™

will insert

the Invoice's reference field.

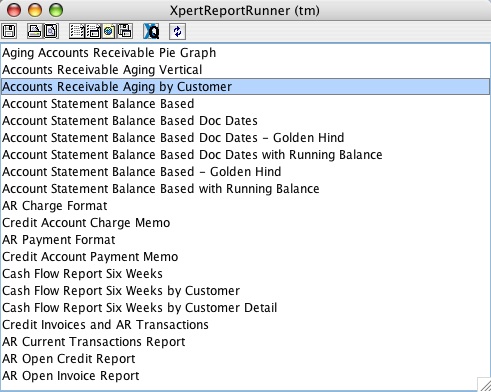

AR

Reports

The

AR Module includes several reports

you can use to manage your client's credit accounts. These are found

by going to Documents>AR Transactions and clicking on the Reports

button. Most of these reports are also found in the Clients

Catalog.

The

"Account Statement Balance Based with Running Balance"

report will produce Balance Statements for each client showing all

activity and the resulting balance for a given date range. The

"Accounts Receivable Aging Vertical" report will show all

the overdue balances grouped by AR Transaction

Period.

Copyright © 2008 Tech

Soft, Inc.